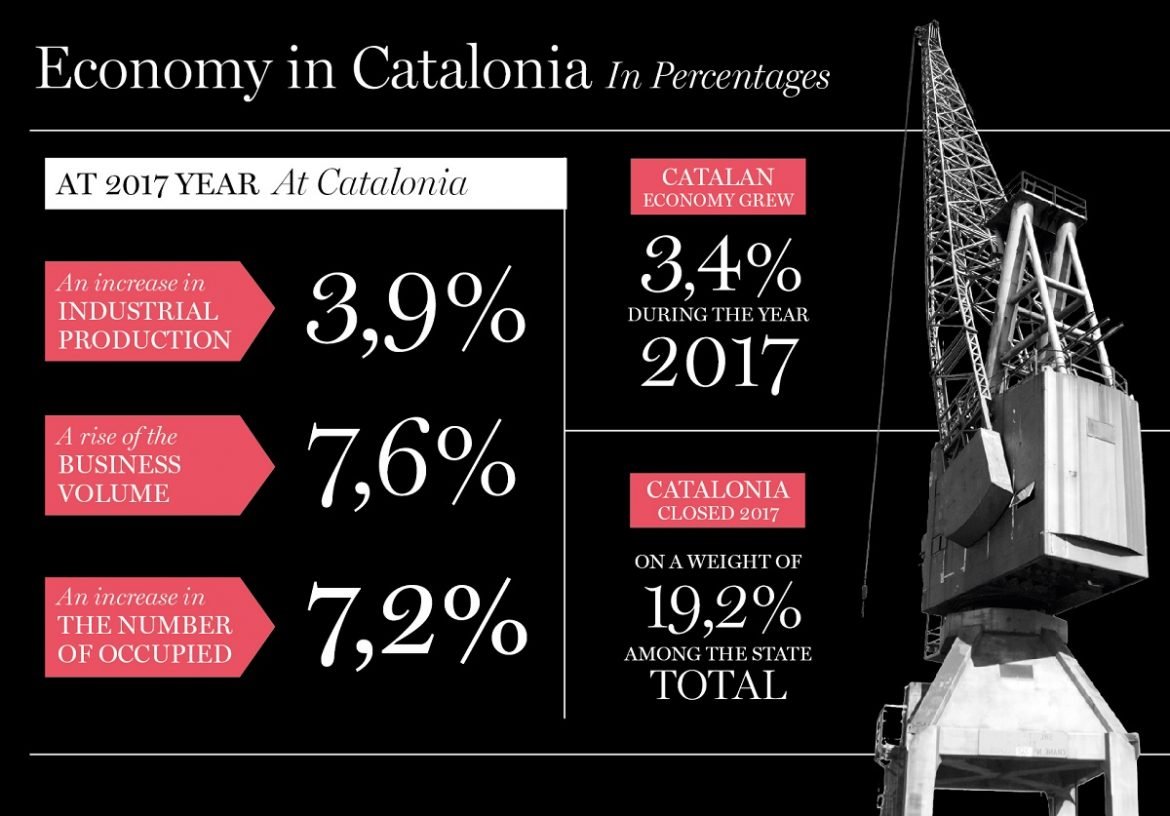

The Catalan economy grew 3.4% in 2017 according to estimates from the Catalan government and the Statistical Institute of Catalonia (Idescat), and 3.3% according to Spain’s National Institute of Statistics (INE) accounting data. In any case, despite fears of political uncertainty, Catalonia closed a particularly good year, with growth above the Spanish average (and a contribution of 19.2% to the national total), and also overtaking the average in the euro zone by one percentage point. This growth came after that registered in 2016 and 2015 (3.5%), consolidating a recovery that began to take off in 2014 when GDP scored a 2.3% increase. The burst from tourism, along with construction coming out its chasm and the relative improvement in domestic demand, are some of the factors that help to explain this chronicle of growth. But without doubt, the true key to this momentum is manufacturing and exports.

The Gross Value Added or GVA of manufacturing accelerated last year to 4.8% year-on-year in the fourth quarter and closed 2017 at 3.7%. Industrial production increased by 3.9%, turnover by 7.6%, and the number of employees by 7.2%. These figures are a slightly more modest than for those in 2016, but they show the strength of a key sector coming out of the crisis. In fact, industrial exports was one of the few bright spots that helped to make up for the almost total gloom in the worst years of the crisis due to the shutdown of domestic demand. It was precisely this internationalisation that helped to prevent industrial production from taking a dive, and when in 2014 internal consumption began to recover, this production was further reinforced. It is true that the industrial GVA has not yet recovered pre-crisis levels—the fall in 2009 and 2010 was very hard—but nobody doubts that it is this manufacturing base that has allowed Catalonia to be at the fore of recovery, compared with the average growth for the whole of Spain.

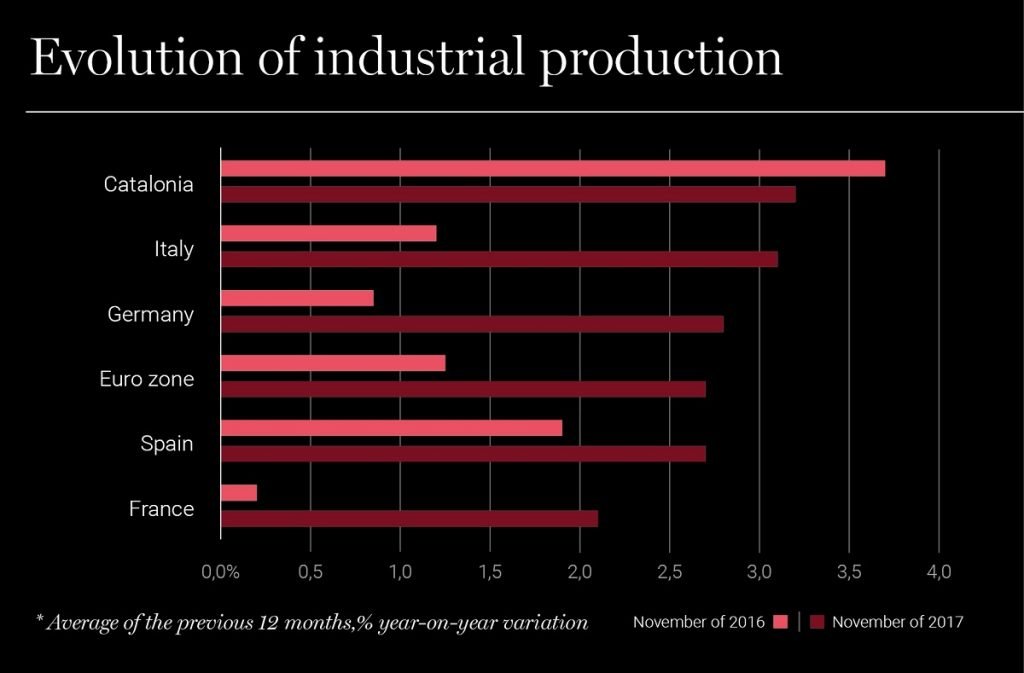

Manufacturing in Catalonia has also eclipsed its economic neighbours. Between 2014 and 2016 the growth of value added in Catalan manufacturing was 1.8 percentage points higher than for the euro zone.

This outstanding role has allowed manufacturing to take pride in and vindicate its role as an economic powerhouse. It has not always been thus. During the years of economic boom and the bonanza of the real estate sector, industry took second place. The weight of industrial GDP in total GDP went from over 25% in 2000 to around 17% a decade later. It is not surprising if we take into account that while the Catalan economy grew briskly during the first years of the new century, industry kept up at a rather discrete pace, nothing to do with the bang recorded by construction and services. Most towns fought to snare real estate or logistic investment projects, but it seemed that no mayor wanted have their picture taken inaugurating a factory.

The role as the ugly duckling had already been established years before, right at the beginning of the last decade. And at the turn of the century, it was accompanied by a huge number of relocations—especially in consumer electronics and other labour intensive sub-sectors—that brought about a sense that manufacturing was exhausted and that the best bet was on other more friendly, less polluting sectors with more immediate results and—why not say so—with much juicier margins. Manufacturing seemed to be a matter for Asian countries and Eastern Europe, with cheaper labour, and while manufacturing went into apparent decline, other activities became the economic backbone of the economy.

But what goes around comes around, and with the bursting of the real estate bubble, bricks and mortar went from being a godsend to being little short of the devil, and manufacturing emerged again as a sector that could generate employment and that was sufficiently internationalised to keep the pace up by exporting, without having to depend on domestic consumption. The last few years have confirmed this idea, as beyond the powerhouse of tourism, manufacturing and its exports have been the lifeblood of the Catalan economy that has led to the record growth in the activity of the Port of Barcelona.

However, that does not mean manufacturing does not present challenges for the future, some of which are very important. To begin with, we will see how the administration defines its action in promotion. After the affected Strategic Agreement of the Three-Party Catalan government and the campaigns to “cleanse” the image of manufacturing, emphasising it as a white-coat industry, the last government launched the National Agreement for Industry together with the social agents—trade unions and employer organisations— with an allocation of €1.8 billion to 2020. The political situation and the lack of government, however, do not presage straightforward deployment. On the other hand, the industry faces the challenge of really getting Dual Vocational Training to work, which is indispensable in order to produce properly qualified skilled workers. The sector also has to face the challenge of assuming high cost energy, which detracts competitiveness against European rivals. But manufacturing also faces the challenge of a real revolution in the deployment of robots and so-called Industry 4.0, and improving productivity. There is a lot of homework to do that will undoubtedly set the immediate future for the sector, but what no longer seems in doubt—and what will last a long time—is that manufacturing is and should continue to be an engine for growth.