[dropcap letter=”O”]

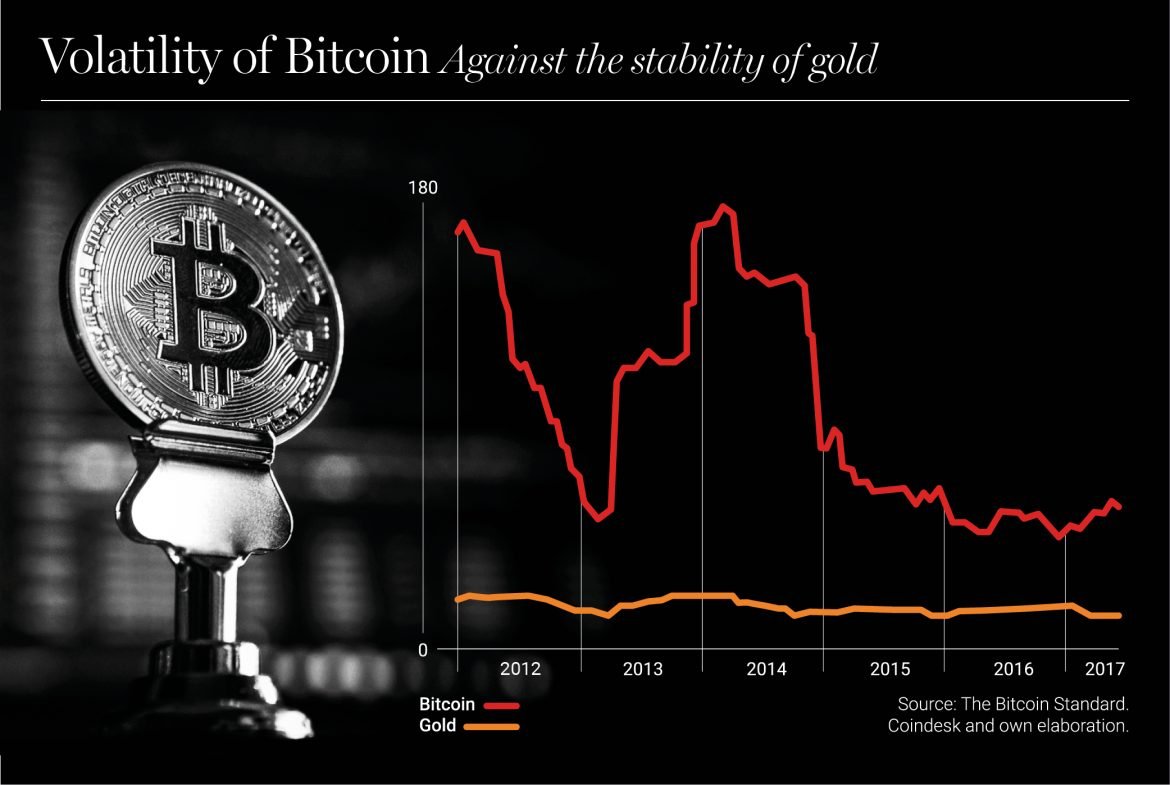

ne of the great technological disruptions of the last ten years has been Bitcoin. First, in a very discreet way, almost secret; then, vertiginously. Some fluctuations in the price have aroused considerable doubts. However, its price has grown from just a few cents at the end of 2009 to more than $ 6,000 when writing these lines, although it drags a drop from the level of 25,000. Regardless of the price, in view of the possibilities and promises that are beginning to draw around this new digital monetary standard, it is easy to understand the interest it arouses.

Approaching Bitcoin in a solvent way, a currency based on decentralized software on an encrypted basis, requires an analysis in two differentiated levels: first, to understand the possibilities of blockchain encryption technology, which allows direct exchange (peer-to-peer) without the need of third parties (something truly revolutionary in the Internet world, today dominated by large intermediaries, i. e., FAANG); and, secondly, and just as important, to understand the main foundations of monetary theory and what properties money must have to fulfil its function of unit of account and deposit of value.

Addressing these two plans is the aim of The Bitcoin standard (recently published in Spanish by Deusto), by the economist Saifedean Ammous. It is probably one of the most effective and rigorous analysis on the possibilities of blockchain in the 21st century. It is a book, essentially, of solvent monetary theory and good economy. The author, before unravelling some of the mysteries and myths that surround Bitcoin and the rest of cryptocurrencies, reflects on the importance and articulation of savings, the temporal preference or the vital importance of the accumulation of capital for the advancement of human civilizations. This allows us to understand the benefits derived from having an economy that grows in a rational way, without inflation, and the prejudices that the irruption of the nationalization and the political use of fiduciary money by a few has implied.

Ammous explains how Bitcoin, on blockchain technology, offers a viable alternative for the future that can solve the historic problem of money, taking advantage of the digital world

A devalued money, whose closest origin is in the system that illuminates Bretton Woods, gives rise to the inflation crisis that knocks down by default any economy, as predicted Henry Hazlitt, and that accelerates massively after the “Nixon shock” of 1971. Since then, we have been accumulating more and more debt, inasmuch as this could be paid by printing unlimited currency, giving rise to an inflationary spiral that turns out to be the origin of the bubbling nature of the bulk of developed economies and the constant erosion of the purchasing power of real salaries.

In this scenario, that structurally tends towards inflation, the latest financial crisis is just one more episode: Ammous explains how Bitcoin, on blockchain technology, offers a viable alternative for the future that can solve the historic problem of money by taking advantage of the benefits of digital world. Any form of money, the author explains didactically, must be able to respond to three basic needs: unit of account, means of exchange and deposit of value; being this last characteristic the one in which all forms of fiduciary money have clearly failed. This is the classic definition of money, that all the authors embrace -from Bernanke‘s first predecessor, John Law, to the famous economists of the Vienna School Carl Menger or Ludwig von Mises, of which the author considers himself a disciple.

In this scenario, that structurally tends towards inflation, the latest financial crisis is just one more episode: Ammous explains how Bitcoin, on blockchain technology, offers a viable alternative for the future that can solve the historic problem of money by taking advantage of the benefits of digital world. Any form of money, the author explains didactically, must be able to respond to three basic needs: unit of account, means of exchange and deposit of value; being this last characteristic the one in which all forms of fiduciary money have clearly failed. This is the classic definition of money, that all the authors embrace -from Bernanke‘s first predecessor, John Law, to the famous economists of the Vienna School Carl Menger or Ludwig von Mises, of which the author considers himself a disciple.

Bitcoin, because of its unique properties, is in a position to become the closest thing to “digital gold”: a new form of money that cannot be manipulated in its offer by politicians or central bankers and, therefore, capable of safeguarding the purchasing power of the savings. And, also, able to support an economy in which money supply has a more neutral role, not so much based on contrived stimuli that subject the economy to a bipolar depressive disorder, oscillating between euphoria and depression. A decentralized money for the 21st century, antifragile, in the fortunate expression of Nassim Taleb (responsible for a marvellous prologue), in the sense that its offer is stable according to a protocol preconceived and unalterable by anything or anyone.

This is the theory, in daily life no one has a crystal ball and it is impossible to know, as the author himself acknowledges, what the fate of Bitcoin will be. In this sense, Bitcoin today seems more an option for a future digital gold, than actual digital gold. The risks are high and future unpredictable, but if the fundamental characteristics of this new technological innovation are disclosed, it will be easy to imagine the important and deep consequences that may derive from its satisfactory development. The book meets the objective of analysing Bitcoin beyond its price, glimpsing what can be its scope and value. A book that, in addition to throwing light on the future of finance, contains invaluable reflections on monetary theory by one of the most interesting young economists on the international scene.